What Casino Games Have the Best Odds of Winning

Whether online or in person, casinos offer ways to make a lot of money and have a hell of a .

Read more

Whether online or in person, casinos offer ways to make a lot of money and have a hell of a .

Read more

Ever wondered if it’s possible to win playing casino games with just a few bucks to spare? While it’s true .

Read more

The spooky season is just around the corner. And there’s no better way to get into the ghostly spirit than .

Read more

If you’re someone who likes to see the world and gamble at the same time, there are a few fine .

Read more

Roulette is probably one of the easiest games to play. It does not follow a certain rule or follow a .

Read more

Typically at casinos, there are table games and there are slots. Table games tend to include anything involving felt, like .

Read more

Sports betting is a favorite among gamblers and avid sports fans. There’s an added level of fun and thrills when .

Read more

Casinos are known for their VIP programs, free drinks, free rooms, and tempting casino perks. It’s one of the things .

Read more

Online casino games like slots have taken the gaming world by storm. There are several reasons for this and perhaps .

Read more

The growing popularity of online casinos is testimony to the sense of security they inspire in the gambling community. As .

Read more

Slots, by nature, are random games. This makes developing any strategy to play slots effectively difficult; however, there are a .

Read more

Mississippi Stud is a popular card game that’s based on the same dynamics as poker. Over the years, the game .

Read more

Discover winning craps strategies, tips, and tricks that will help you get the most out of your time at the table. Brought to you by experts at CoolCat Casino.

Read more

Are you tired of having to hand over your chips and hard-earned cash after every poker game with friends? Is .

Read more

If you’re new to playing video poker, it’s crucial to have a solid understanding of the different hands and how .

Read more

The Grammy Awards is one of the world’s most prestigious music award ceremonies. But when it comes to betting on .

Read more

So, you’ve decided to join an online casino but you’re not sure where to start — allow us to help .

Read more

The chance to play games like Wheel of Fortune or Break the Bank without even needing to step foot outside .

Read more

Pocket pairs can be incredibly profitable when it comes to poker hands. Nevertheless, if you fail to play them right, .

Read more

If you’re already a regular player of casino games, you’ll know just how much of a rewarding and therapeutic activity .

Read more

It may have been a tumultuous year for the casino industry. But thanks to nationwide lockdowns, online gambling has never .

Read more

Poker has always been one of the most beloved casino games. Television shows like Celebrity poker have made this game .

Read more

Poker is undeniably the most-played card game in the world. Each season, the biggest tournaments like the World Series of .

Read more

Music is used throughout our daily lives, whether for entertainment purposes, to assist with learning or studying, or as part .

Read more

Playing dice games like craps or streets is a popular pastime for people worldwide. Whether it is testing your luck .

Read more

From railroad pioneers to eccentric billionaires, these magnificent 7 helped build Las Vegas. Known as ‘the meadows’ in Spanish, Las .

Read more

Poker is a game played with specific rules. But there are tons of useful tricks — or cheats should we .

Read more

Online slot machines have always worked in a similar fashion to their predecessors. You place your bets, hit spin, and .

Read more

Humans have been gambling and playing games of chance since ancient times. In those days, we would use everything from .

Read more

The CrossFit Games are an annual athletic event where men and women compete for the title of “Fittest on Earth.” .

Read more

Long before skateboarding dogs, Grumpy Cat, and fainting goat videos, there was “Dogs Playing Poker.” This iconic 18-piece series features .

Read more

Gambling may be completely outlawed in some countries, but most of them still provide the opportunity to purchase tickets for .

Read more

Casinos both online and offline are often tarnished as money-grabbing organizations who are involved in the conduction of criminal activity. .

Read more

Pachinko is Japan’s primary gambling indulgence. Although the game has been around for almost 80 years, the country’s dedicated Pachinko .

Read more

Gambling is a fun and profitable pastime enjoyed by people all over the world. And one of the industry’s most .

Read more

Japan is best known for its wild and stunning mountainous terrain, super high-speed trains, herbal teas, anime, martial arts and .

Read more

There are not many people in the world who actually enjoy being stuck at an airport. Even if you’re a .

Read more

With the massive success of tribal mega-resort casinos like Mohegan Sun and Foxwoods Resort, people might get the idea that .

Read more

There are multiple moves you can make in blackjack. And if you know how to execute them correctly, you can .

Read more

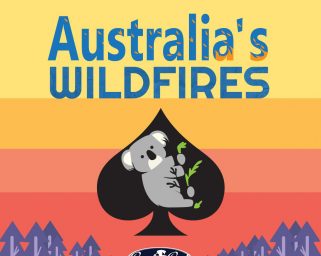

Australia is one of the most fire-prone regions on Earth, and bushfires in Australia are a regular occurrence. For millions .

Read more

Want to become a better gambler? Read on for our tips. Most gambling websites these days espouse some sort of .

Read more

The first casinos to rise up out of the Las Vegas desert in the 1930s resembled cowboy saloons crossed with .

Read more

Casinos. You love ‘em or you hate ‘em. Or maybe you’re indifferent. All sorts of casino critics spout doom and .

Read more

Slot machines have come a long way since the one-armed bandits of the casino floor. Thanks to online slots, these .

Read more

You’ve probably heard endless horror stories of innocent gamblers hitting jackpots in Vegas, only for them to cash in their .

Read more

Two American guys living in London in the 70s really missed the all-American burger. So they opened up a little .

Read more

Humans have been wagering for eons, and the only thing that rivals our need for wagering is the staggering amount .

Read more

Scratch cards are an easy and exciting way to win a few extra bucks. But like anything else people choose .

Read more

It’s no secret that the bible depicts gambling as a highly frowned-upon act. There are no sections in the holy .

Read more

Global gambling laws appear to be relaxing in favor of casinos. As a result, new casinos regularly pop up in .

Read more

Parimutuel betting has been a popular form of gambling since the mid-1800s. In recent years, the extent to what actually .

Read more

Skin gambling: just the name itself sounds like something out of horror movie. A plot featuring avid gamblers who’ve lost .

Read more

Is it possible to do Vegas on a budget? When most people picture Las Vegas in their heads, a typical .

Read more

How does a banker with an accidental interest in poker beat the world’s greatest poker pros? It helps to be .

Read more

A night out at your local casino is a great way to blow off steam and have some fun. Quite .

Read more

Since time immemorial, humans have been gambling beasts. Taking risks is a form of thrill, and few things are more .

Read more

In order to be a legend, you must loom large in the imagination of your peers. People will give you .

Read more

For the last 50 years, people from all over the world flocked to a small casino town in the middle .

Read more

Casinos can be a fantastic place to work. There’s the fancy décor, gourmet-style eateries, classy dress codes and overall buzzing .

Read more

Historic Overview Long before online casinos appeared, humans gambled. The act of gambling dates as far back into the Paleolithic .

Read more

Boardwalk Empire is an award-winning HBO series about the life and times of Enoch “Nucky” Thompson, and how he controlled .

Read more

Have you ever logged onto an online casino platform, only to be bombarded with pop-ups offering bonuses? You may wonder .

Read more

There are many theories surrounding the origins of the Joker card. While it is not definitively known just how it .

Read more

Civilizations across the world have gambled for thousands of years. But with the rapid evolution of technology, online casinos are .

Read more

The tradition of dimming the lights on the Vegas Strip is not a new one. Before the October 1 memorial .

Read more

There are several factors to consider when choosing the best casino game. A particular casino game may be great for .

Read more

We’ve seen it in movies like Mission Impossible, Blade Runner, and Alien for decades. Biometric authentication is a futuristic concept .

Read more

There’s no better way to relax and unwind than jetting off to exotic casinos. Play where the sun shines constantly. .

Read more

A progressive slot machine offers a jackpot that increases every time a player drops a coin into the machine. Fixed .

Read more

Many casino cons have tried and failed at out-doing casinos over the years. But there are a select few who .

Read more

The special administrative region of Macau was once a former Portuguese colony. It is now one of the richest regions .

Read more

Blackjack seems like a simple game. Just hit 21 without going over and you win, right? The basic rules of .

Read more

When most people think of addictions, they picture a chemical dependency on alcohol or drugs, one which robs the user .

Read moreToday’s world of casino slots is simply dazzling. The choices in type of game, style, theme, bonuses and jackpots is .

Read more

Former Cambridge Analytica employee Brittany Kaiser has told The New York Times the firm was working with Macau based gaming .

Read more

From big money billionaires to super wealthy socialites, society’s mega-rich rock bankrolls and lifestyles that few can dare to imagine. .

Read more

Oceanic themes are both calming and captivating, and it’s no different when it comes to casino games. Enter: aquatic-themed slots. .

Read more

In the grand old United States of America, the history of gambling has had a long and winding journey to .

Read more

If you’ve been around for a few years, then you may have noticed just how much slots have changed in .

Read more

July 4th is Independence Day for the United States of America, a time when people drink copious amounts of beer .

Read more

In the world of online casinos, a new trend has come to the forefront of virtual gambling. If you’ve ever .

Read more

Everyone knows about keno, whether it’s because they’re fans of the game or they’ve seen those big ball machines rolling .

Read more

Gilbert Bates carries the Stars and Stripes 1800 miles Gilbert Bates was a sergeant in the 1st Wisconsin Heavy Artillery .

Read more

Cleopatra VII spends 10m on one meal Cleopatra VII, the most famous Cleopatra of all, was the last Ptolemaic ruler .

Read more

Some of the best stories to grace the history books began with a simple bet. Dr. Seuss wrote The Cat .

Read more

Want to play the exciting Aladdin slot game? Daring swordfights, exotic animals, and riches beyond your wildest dreams. Here at .

Read more

How Do You Control Your Emotions While Gambling? Some people seem to have astounding control over their emotions while gambling .

Read more

You think that poker is a man’s game? The following gambling women will make you think again. Some of the .

Read more

So, you’ve heard about online gambling, you’ve seen a few friends play, and maybe you’ve even browsed some websites yourself. .

Read more

Want to read about some fun gambling facts? Let’s go back to the beginning. The very first instance of gambling .

Read more

Welcome to the wild world of celebrity gambling. CoolCats are cool, famous cats are famous. $100,000 buy in? $1 million .

Read more

So you have won! And you are ready to make a withdrawal. Congratulations! At CoolCat Online Casino, we want to .

Read more

You did it! You’ve signed up, made your first deposit, and got your bonus. So now what? You might ask. .

Read more

People often wonder how to make a deposit and claim their bonus. It’s surprisingly simple, and it probably takes less .

Read more

What’s your fondest 4th of July memory? Mine happened about 10 years ago. It was a big neighborhood picnic that .

Read more

When you spin the Roulette wheel, you aren’t just spinning to win. You’re spinning a piece of history. Today, we’re .

Read more

Need to know about free chip rules? Read on! The best thing about online casinos, other than the convenience, great .

Read more

If you’re used to playing slots and you refuse to try anything else, you’re a lot like other casino players. .

Read more

While China’s special administrative region of Macau is recognized as the largest gambling hub on the planet, the mainland is .

Read more