Sports Gambling and Casino Winning Streaks

The list of some incredibly lucky people continue. These people have encountered what are arguably the greatest winning streaks in .

Read more

The list of some incredibly lucky people continue. These people have encountered what are arguably the greatest winning streaks in .

Read more

Thinking of playing Baccarat for real money? Before you sit down, bring this checklist with you. It’s what smart, winning .

Read more

Wins in casinos come in all shapes and sizes, and, occasionally, they are simply too amazing to ignore. In 2014, .

Read more

There are plenty of great games at the casino, but there’s just something about blackjack. Gamblers around the world have .

Read more

Sometimes you have to take your hat off to the people working in casinos. Not only do they endure endless .

Read more

Despite well-executed depictions in blockbusters such as 21, The Cooler, Rain Man and Maverick – Cheating in casinos isn’t just .

Read more

The casinos had never seen anything like Keith Taft. An unsuspecting family wanders in off the Reno Strip, and finds .

Read more

The gambling capital of the world is home to more than just slot machines, shot-gun weddings, five-star restaurants, cat houses .

Read more

Are you the superstitious type? Do you believe in lost spirits condemned to walk the earth in torment while haunting .

Read more

There was gambling in ancient times. Believe it or not, civilizations have gambled since the Paleolithic period, aka before history .

Read more

Who were the first women in poker? As far back as records indicate, gambling has been a significant source of .

Read more

Gambling has a rich and storied history around the world. Learn more about the fascinating games and global traditions as .

Read more

Regardless of where you visit, odds are that you will encounter games of chance throughout the world in one form .

Read more

Las Vegas and the world’s preferred gambling destinations have long been famous for their casinos. They’re perhaps equally famous for .

Read more

A trip to land-based casinos can be a fun and thrilling experience. You get to play fast-paced and exciting casino .

Read more

When it comes to casinos and gambling, there is one ugly reality, which operators must face, cheating. Casinos are constantly .

Read more

The long and interesting history of gambling would not be complete without mentioning the top casinos of the world. Their .

Read moreSports and gambling go hand in hand. Many people love to up the ante by betting on the outcomes of .

Read more

Ever wonder about gambling in London? Gambling whether at land-based or online casinos is a big deal, a real big .

Read more

It’s no secret that Las Vegas is a town rich with casino culture. Its long and lively history is comprised .

Read more

So you’re going on a cruise? How about gambling on cruise ship casinos? If you’ve done anything more than a .

Read more

Video games and slot machines may seem like unlikely companions, but the truth of the matter is that they go .

Read more

Do you need a lucky charm when you gamble? We all know that the universe is made up of completely .

Read more

At one point or another, everyone has heard of the iconic quintet, the epitome of cool, the Rat Pack. What .

Read more

Pizza… We all know it, we all love it, and most importantly we love to eat it! There seems to .

Read more

Want to play the hottest slots for men? Read on and play slots for real money! Many might argue that .

Read more

Do you want to become a good poker player with the strategies of the most successful poker players online? Do you .

Read more

The list of some incredibly lucky people continue. These people have encountered what are arguably the greatest winning streaks in .

Read more

Who had the greatest winning streaks of all time? Whether it boils down to being in the right place at .

Read more

Are you bored? It’s time for fun office games! You’ve been moseying around on the Internet for a while, and .

Read more

Have you ever thought about zodiac sign games that are perfect for you? According to astrologers, seers, and fortune tellers, .

Read more

The high life of VIPs Sure, we’d all like to get a taste of the VIP casino high life. Who .

Read more

Have you ever dreamed about seeing the rise of Las Vegas, with its flashing lights and hopeful gamblers flocking towards .

Read more

Thinking of playing Baccarat for real money? Before you sit down, bring this checklist with you. It’s what smart, winning .

Read more

Whether you’re a seasoned veteran at the poker poker tables of Las Vegas casinos or an online ace that strikes .

Read more

Bored of run of the mill casinos? You know, like Paris Las Vegas or that new Studio City one that .

Read more

A lot of Americans tend to take casino gambling for granted. After all, Las Vegas is a short flight from .

Read more

There’s just something about Las Vegas that attracts people from nearly every walk of life. Sure, the casinos definitely have .

Read more

Growing up in the ’80s was awesome. It was a simpler time. No iPads. No constant social networking communication. Instead .

Read more

Excited to play Blackjack? We don’t blame you. It’s one of the best casino games on the floor, and one .

Read more

If you can’t take a trip to the casino, watching a casino film is the next best thing. Casinos provide .

Read more

Love casino games? You can thank Native Americans for introducing the gambling concept to US shores. Sure, colonists did bring .

Read more

The gaming industry has been changing non-stop for the past two decades. Who would have dreamed of the heights games .

Read more

As the old saying goes, “Where there’s a will, there’s a way.” This is certainly a very positive and encouraging .

Read more

Gambling has always being a part of human history. In fact, there is a Hindu hymn called the Gambler’s Lament .

Read more

In the field of literature, Russian writer Fyodor Dostoevsky is known for being one of the great psychological writers in .

Read more

I love to bet when I travel overseas. Getting the chance to travel to exotic destinations, relax by a pool .

Read more

Many of you wrote to us asking what the big fuss is about online casino scratch cards. Others asked us .

Read more

A few weeks ago, I was sitting at a dinner table with five other guys when suddenly a whole discussion .

Read more

Many of you have asked us to give you tips on how to have a casino themed date either at .

Read more

Have you ever thought about the amount of fictional gambling characters that all of us, around the world, know? I .

Read more

No, I’m not out of subjects for posts, no. I’m actually responding a question that I keep getting from gamblers .

Read more

Have you ever dated someone you met while playing online poker? Everyone knows that if you play in an online .

Read more

I have never been a guy who is a friend of conventionality. With that being said, I’m always on the .

Read more

The Game: As we look back now, it would be hard to imagine the world as we know it without .

Read more

The slot machine is an instant draw to newbies and seasoned gaming veterans alike. There is just something about the .

Read more

In nearly every movie featuring a casino, there is a scene or a snippet that includes someone throwing dice and .

Read more

Gamblers from all over the world, of all ages, all levels of experience, all interests, and all kinds of backgrounds .

Read more

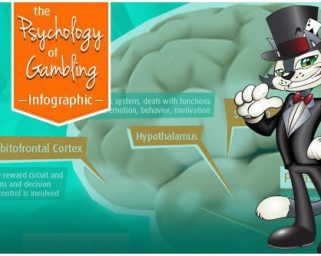

When we play games, (any type of game) certain parts of our brains activate and some situations will cause specific .

Read more